Clarity for go / no-go expansion decisions

Entering new markets requires evidence, not optimism. We help leadership teams assess feasibility, risk, and entry options before committing capital and resources.

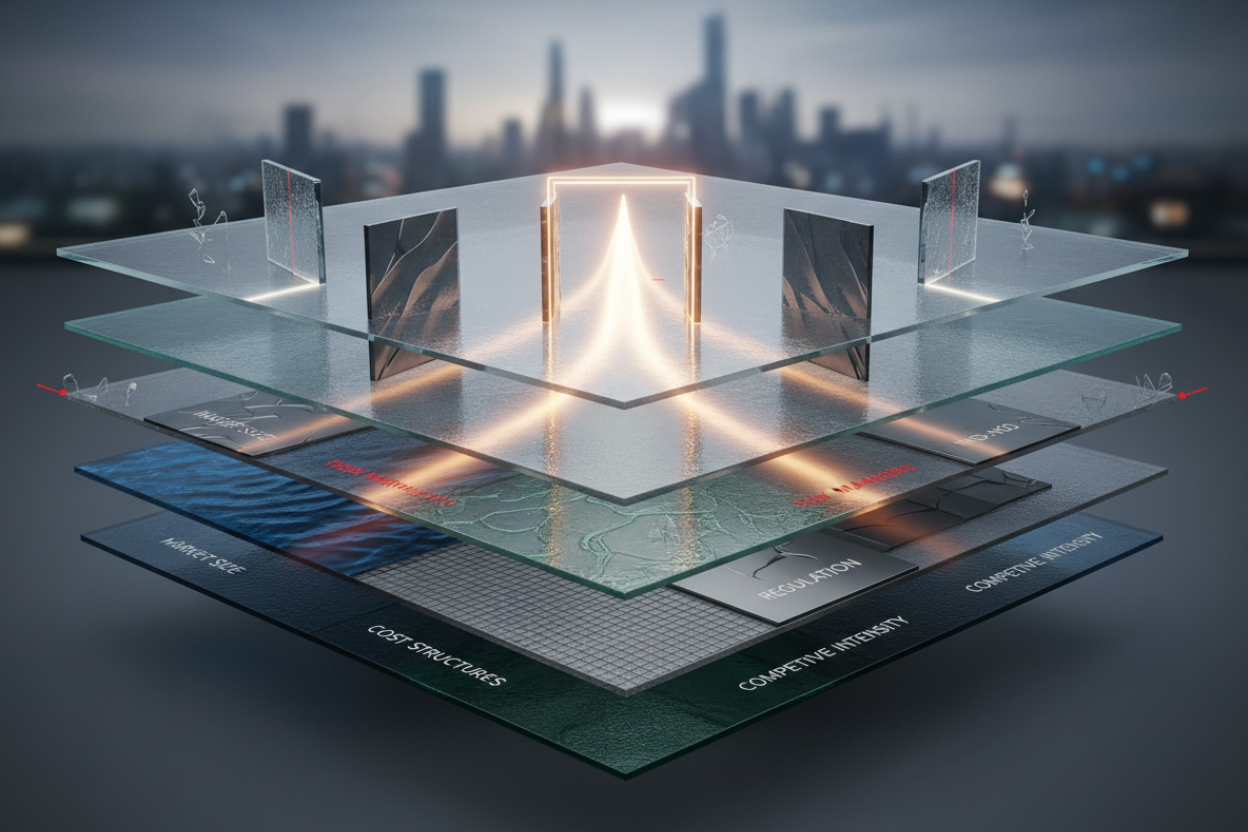

Market Feasibility Baseline

We assess market size indicators, demand drivers, competitive landscape, regulatory environment, and cost structures.

Expert and Local Inputs

Where data is insufficient, we incorporate expert, partner, and operator inputs to reflect on-the-ground reality.

Risk and Assumption Discipline

Demand assumptions, regulatory interpretations, and cost estimates are clearly documented, with their limitations and implications.

Entry Option Validation

Entry modes and rollout options are cross-validated against market attractiveness, barriers to entry, and operational readiness.

Managing Entry Uncertainty

Conflicting signals on demand, regulation, or competition are surfaced and addressed through scenarios and trade-offs.

Best Use Cases for This Engagement

New country entry, regulated markets, new customer segments, and investor or board-level feasibility decisions.

What You Receive

Market feasibility deck, competitive and regulatory summary, risk register, entry options, and phased entry plan.